Municipals were a touch weaker in spots ahead of another robust new-issue calendar. U.S. Treasury yields rose and equities were up.

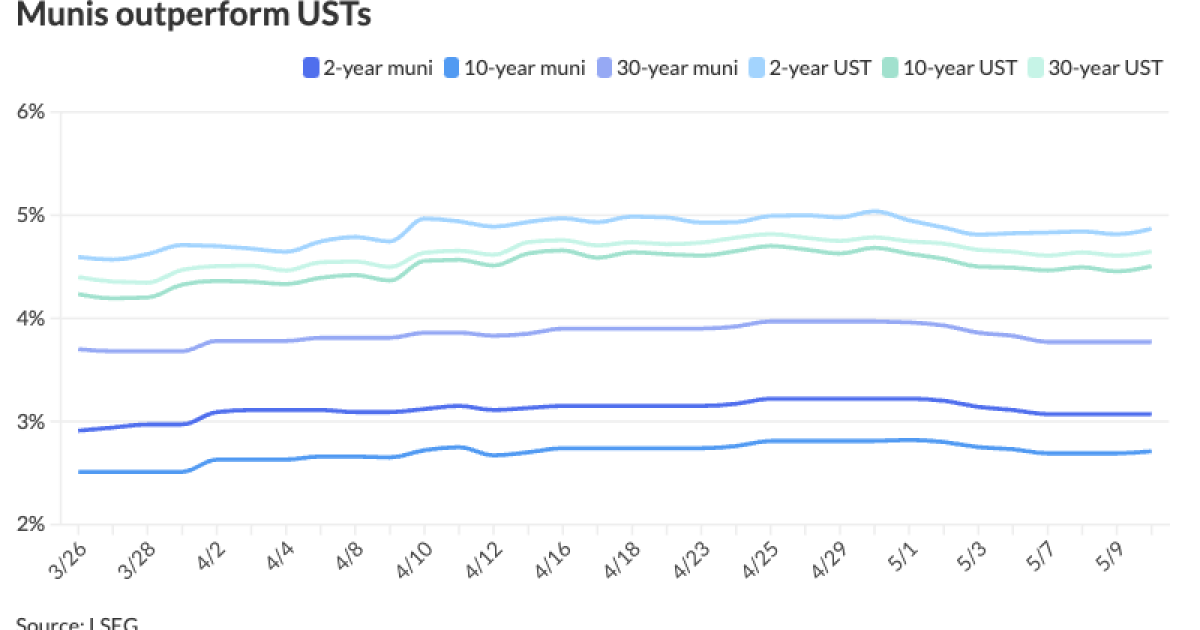

The two-year muni-to-Treasury ratio Friday was at 63%, the three-year at 62%, the five-year at 60%, the 10-year at 60% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 63%, the five-year at 61%, the 10-year at 61% and the 30-year at 82% at 3:30 p.m.

Despite issuance surging to an estimated $10 billion this week, the market continues to feel “quite strong” as June approaches, according to Barclays PLC.

Additionally, investors have not been “deterred” by the rise in issuance over the past several weeks, said Barclays strategists Mikhail Foux and Clare Pickering.

“Moreover, with June 1 coupon payments and redemptions just several weeks away, investor focus has shifted toward supportive technicals over the course of the summer,” they said.

Over the past five years, Barclays strategists said, “tax-exempts have frequently underperformed USTs by a wide margin from June 1 to August 31 (i.e., in 2021 and 2022), and even in some of the better years for munis (i.e., in 2020, an atypical year due to COVID), tax-exempts did not outperform UST that much.”

This year may look like 2021 due to expected heavy supply and possible positive net issuance due to lighter summer redemptions, they said.

During the summer, a muni market rally is expected to be “gradual and methodical as the economy is entering a Goldilocks zone and macro market volatilities come down steadily,” BofA strategists said, noting, “credit spread compression will continue during the summer months.”

The economy should remain “largely resilient” despite some weakening, BofA strategists said.

“Credit spread compression will be based more on yield searching in munis due to a supply/demand imbalance,” they said.

“While tactical investors might try to take advantage of the stronger muni market in the near term, we think investors should remain cautious as this summer might end up relatively difficult for the muni market — how many $10-plus billion supply weeks in a row can the muni market absorb?” Barclays strategists asked.

The market will start facing that test next week as the new-issue calendar remains robust at $9.858 billion with $8.419 billion on tap for the negotiated market and $1.439 billion in the competitive market.

The New York City Transitional Finance Authority leads the new-issue calendar with a total of $1.8 billion of future tax-secured subordinate bonds in the negotiated and competitive markets.

Other large deals include the Dormitory Authority of the State of New York with $965 million of School Districts Revenue Bond Financing Program revenue bonds and the San Francisco Airport Commission with $925 million of San Francisco International Airport second series revenue refunding bonds.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 3.23% (unch) and 3.07% (unch) in two years. The five-year was at 2.72% (unch), the 10-year at 2.71% (+2) and the 30-year at 3.77% (unch) at 3 p.m.

The ICE AAA yield curve was cut one to two basis points: 3.24% (+1) in 2025 and 3.09% (+1) in 2026. The five-year was at 2.75% (+2), the 10-year was at 2.72% (+2) and the 30-year was at 3.76% (+1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to two basis points: The one-year was at 3.25% (unch) in 2025 and 3.06% (unch) in 2026. The five-year was at 2.71% (+2), the 10-year was at 2.70% (+2) and the 30-year yield was at 3.76% (unch), according to a 3 p.m. read.

Bloomberg BVAL was little changed: 3.31% (unch) in 2025 and 3.11% (unch) in 2026. The five-year at 2.66% (+1), the 10-year at 2.64% (unch) and the 30-year at 3.79% (unch) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.867% (+5), the three-year was at 4.674% (+5), the five-year at 4.519% (+5), the 10-year at 4.505% (+5), the 20-year at 4.748% (+4) and the 30-year at 4.647% (+4) at 3:30 p.m.

Primary to come

The New York City Transitional Finance Authority (Aa1/AAA/AAA/) is set to price Wednesday $1.5 billion of tax-exempt future tax-secured subordinate bonds, Fiscal 2024 Series G, Subseries G-1. RBC Capital Markets.

The Dormitory Authority of the State of New York is set to price Wednesday $965.415 million of School Districts Revenue Bond Financing Program revenue bonds, consisting of $792.985 million of Series 2024A (Aa3/AA/AA-/), serials 2025-2044, terms 2048, 2052; $46.11 million of Series 2024B (Aa3/AA/AA-/), serials 2025-2039; $59.75 million of Series 2024C (Aa2//AA-/), serials 2025-2039; and $66.57 million of Series 2024D (/AA/AA-/), serials 2025-2039. Raymond James.

The San Francisco Airport Commission (A1//A+/) is set to price Tuesday $924.665 million of San Francisco International Airport second series revenue refunding bonds, consisting of $782.33 million of Series 2024A, $123.715 million of Series 2024B and $18.62 million of Series 2024C. Goldman Sachs.

The New Jersey Turnpike Authority is set to price Tuesday $697.785 million of forward-delivery turnpike revenue bonds, Series 2024 C. Morgan Stanley.

The California Health Facilities Financing Authority (/BBB+/BBB+/) is set to price Tuesday $588.8 million of Adventist Health System/West fixed mode revenue bonds, Series 2024A. RBC Capital Markets.

Miami-Dade County, Florida, (Aa3/AA/AA-/) is set to price Tuesday $494.66 million of water and sewer system revenue bonds, consisting of $323.16 million of new-issue bonds, Series 2024A, and $171.5 million of refunding bonds, Series 2024B. Goldman Sachs.

The Los Angeles Department of Water and Power (Aa2/AA+//AA+/) is set to price Thursday $448.485 million of water system revenue bonds, 2024 Series B, serials 2024-2044. TD Securities.

The University of Texas System is set to price next week $425 million of Permanent University Fund bonds, Series 2024B. BofA Securities.

The Adventist Health System/West (/BBB+/BBB+/) is set to price Thursday $390.76 million of taxable corporate CUSIPs, Series 2024, serial 2034. RBC Capital Markets.

The Tarrant Regional Water District, Texas, (/AAA/AA+/) is set to price Tuesday $314.845 million of water revenue refunding and improvement bonds, Series 2024. Jefferies.

The Port of Greater Cincinnati Development Authority is set to price Thursday $292.195 million of tax-exempt Duke 1 Energy Convention Center Project-Transient Occupancy Tax development revenue and refunding bonds, consisting of $56.685 million of senior development revenue and refunding bonds, Series 2024A (Aa3/AA//), serials 2024-2043, terms 2048, 2053, 2058, 2063; $192.855 million of first subordinate development revenue and refunding bonds, Series 2024B (A2/A-//), serials 2025-2043, terms 2048, 2053, 2058, 2063; and $42.655 million of second subordinate development revenue bonds, Series 2024C (A3/BBB//), serials 2029-2043, terms 2048, 2053, 2058, 2063. BofA Securities.

The Oklahoma City Water Utilities Trust (Aaa/AAA//) is set to price next week $269.88 million of non-AMT utility system revenue refunding and improvement bonds, Series 2024. Morgan Stanley.

The Greenwood Independent School District, Texas, (/AAA/AAA/) is set to price Thursday $256.33 million of PSF-insured unlimited tax school building bonds, Series 2024, serials 2025-2054. Jefferies.

The Arlington Higher Education Finance Corp., Texas, (/AAA//) is set to price Tuesday $206.96 million of PSF-insured Harmony Public Schools education revenue bonds, Series 2024, serials 2026-2039, terms 2044, 2049, 2054. Baird.

The Ector County Independent School District, Texas, (Aaa/AAA//) is set to price Tuesday $179.905 million of PSF-insured unlimited tax school building bonds, Series 2024-A, serials 2025-2045. Raymond James.

The Tennessee Housing Development Agency (Aa1/AA+//) is set to price Tuesday $178.5 million of social taxable Residential Finance Program bonds, ISSUE 2024-2B, serials 2025-2035, terms 2039, 2044, 2049, 2054, 2055. RBC Capital Markets.

The Board of Trustees of the University of Illinois (Aa2/AA-//) is set to price Wednesday $171.525 million of University of Illinois auxiliary facilities system revenue bonds, consisting of $146.315 million of refunding bonds, Series 2024A, serials 2025-2044, and $25.21 million of taxable, Series 2024B, serials 2025-2039, term 2044. BofA Securities.

The Colorado Housing and Finance Authority (Aaa/AAA//) is set to price Wednesday $145.51 million of taxable Class I single-family mortgage bonds, 2024 Series C-1, serials 2026-2034, terms 2039, 2044, 2054. RBC Capital Markets.

Georgetown, Texas, (/AA//) is set to price Wednesday $125.89 million of BAM-insured utility system revenue bonds, Series 2024, serials 2025-2044, terms 2049, 2054. BOK Financial Securities.

Utica Community Schools, Michigan, (/AA//) is set to price Tuesday $123.405 million of 2024 school building and site and refunding bonds, serials 2025-2039. Stifel Nicolaus.

Alaska (Aa3/AA//AA/) is set to price Thursday $110.5 million of GO refunding bonds, Series 2024A. Goldman Sachs.

Competitive

Celina, Texas, (Aa1/AA//) is set to sell $138.305 million of limited pledge tax and waterworks and sewer system revenue certificates of obligation, Series 2024, at noon Tuesday.

The New York City Transitional Finance Authority is set to sell $158.59 million of taxable future tax-secured subordinate bonds, Fiscal 2024 Subseries G-2, at 10:45 a.m. Wednesday, and $141.41 million of taxable future tax-secured subordinate bonds, Fiscal 2024 Subseries G-3, at 11:15 a.m. Wednesday.

Virginia Beach, Virginia, is set to sell $146.084 million of GO public improvement bonds, Series 2024A, at 10 a.m. Wednesday; $118 million of GO public improvement bonds, Series 2024B, at 10:30 a.m. Wednesday; and $39.435 million of GO public improvement refunding bonds, Series 2024C, at 11 a.m. Wednesday.

The Virginia Beach Development Authority, Virginia, is set to sell $34.005 million of public facility revenue bonds, Series 2024A, at 10 a.m. Thursday; $27.31 million of public facility refunding revenue bonds, Series 2024B, at 10:30 a.m. Thursday; and $130.655 million of taxable public facility revenue bonds at 11 a.m. Thursday.