Municipals were steady to slightly weaker in spots Monday ahead of a rebound in issuance that tops $8.5 billion. U.S. Treasuries were weaker and equities were up.

Triple-A yield curves saw yields rise up to three basis points, depending on the scale, further softening ahead of a growing new-issue slate and the last week before the tax-filing deadline.

Second quarter issuance “is ramping up across a variety of sectors, with the market’s sights set on remaining redemptions yet to be deployed and the approaching FOMC meeting,” noted Kim Olsan, senior vice president of municipal trading at FHN Financial.

Generic benchmarks corrected higher by 10 basis points or more in the first week of the second quarter, “improving absolute values and taxable equivalent yields,” she said.

“Those moves place the 10-year [Refinitiv] MMD at a 2024 high of 2.66% and the 30-year spot at 3.81% — each basically near their six-month average ranges,” Olsan added.

Yields are expected to continue to move higher due to stronger-than-expected economic figures, especially Friday’s jobs report, seen over the past several weeks, said Jason Wong, vice president of municipals at AmeriVet Securities.

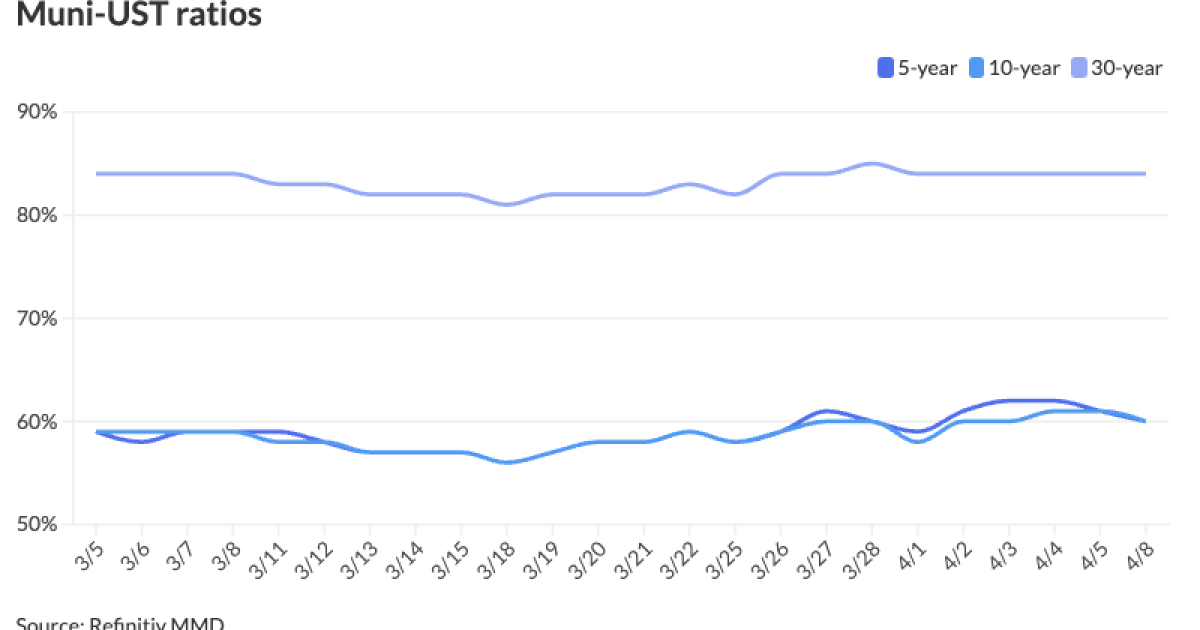

Munis also continue to cheapen across the curve as ratios keep inching back up to more normal averages, he said.

The two-year muni-to-Treasury ratio Monday was at 65%, the three-year at 63%, the five-year at 60%, the 10-year at 60% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 66%, the three-year at 64%, the five-year at 62%, the 10-year at 62% and the 30-year at 84% at 3:30 p.m.

The 10-year ratio hit a four-year low of 59.90% three weeks ago, Wong said.

Since then, the 10-year ratio has risen around five percentage points, he said.

“The large cash balances, April 1 reinvestment cash flow, lighter primary calendar and higher outright yields helped spur increased buying [last] week,” Birch Creek strategists said.

J.P. Morgan reported purchases jumped 21% compared to recent average “with the largest volumes in 20-year-plus maturities and 0-5-year, presumably acting as a low-risk placeholder,” they said.

“While the slightly wider ratios help, it seems accounts are still relatively cautious given historically tight valuations, Treasury yield trajectory, and expectations for heavier new issue over the coming weeks,” they said.

This week’s calendar tops $8.5 billion with several large credits in the negotiated and competitive space.

The new-issue calendar is led by California in the competitive market with $1.48 billion of various purpose GOs in three series, followed by the Massachusetts Development Finance Agency in the negotiated market with $750 million of

Other large deals for the week include the Sacramento Municipal Utility District with $650.305 million of electronic revenue bonds in two deals, Kentucky with $632.83 million of

There are also several other large deals on tap in the coming weeks.

The Florida Development Finance Authority is set to price as early as next week $2 billion of tax-exempt Brightline Florida Passenger Rail Project revenue bonds.

The state of Florida is set to price $1.5 billion of taxable State Board of Administration Finance Corp. revenue bonds.

The Triborough Bridge and Tunnel Authority is set to price the week of May 6 $950 million of payroll mobility tax senior lien green bonds.

Houston is set to price $845 million of Combined Utility System first lien revenue refunding bonds.

The New York City Municipal Water Finance Authority is set to price next week $750 million of water and sewer system second general resolution revenue bonds.

The Port Authority of the State of New York and New Jersey is set to price the week of April 22 $600 million of new-money and refunding bonds.

The Arizona Board of Regents is set to price $530 million of Arizona State University SPEED revenue bonds in two deals.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 3.32% (-2) and 3.09% (-2) in two years. The five-year was at 2.68% (unch), the 10-year at 2.66% (unch) and the 30-year at 3.81% (unch) at 3 p.m.

The ICE AAA yield curve was cut up to three basis points: 3.37% (+3) in 2025 and 3.13% (+1) in 2026. The five-year was at 2.71% (unch), the 10-year was at 2.71% (+3) and the 30-year was at 3.80% (+3) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut up to one basis point: The one-year was at 3.38% (unch) in 2025 and 3.12% (unch) in 2026. The five-year was at 2.71% (+1), the 10-year was at 2.68% (+1) and the 30-year yield was at 3.80% (+1), according to a 3 p.m. read.

Bloomberg BVAL was cut up to two basis points: 3.34% (unch) in 2025 and 3.11% (unch) in 2026. The five-year at 2.63% (+1), the 10-year at 2.63% (+1) and the 30-year at 3.82% (+2) at 3:30 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.788% (+4), the three-year was at 4.602% (+4), the five-year at 4.428% (+4), the 10-year at 4.419% (+2), the 20-year at 4.656% (flat) and the 30-year at 4.551% (flat) at 3:45 p.m.

Negotiated calendar:

The Massachusetts Development Finance Agency (Aaa/AAA//) is set to price Tuesday $750 million of Harvard University Issue revenue bonds, Series 2024B. Goldman Sachs.

Kentucky (A1//AA-/) is set to price next week $632.830 million of Kentucky State Property and Buildings Commission of Project No. 130 revenue bonds, consisting of $222.095 million of Series 2024A and $410.735 million of Series 2024B. BofA Securities.

The Dormitory Authority of the State of New York (Aa1/AA//) is set to price Wednesday $610 million of Cornell University revenue refunding bonds, Series 2024A, serial 2054. BofA Securities.

The Sacramento Municipal Utility District, California, (Aa2//AA/) is set to price Tuesday $400.305 million of electric revenue refunding bonds, consisting of $378.655 million of Series N-1, serials 2029-2036; and $21.650 million of Series N-2, serial 2036. BofA Securities.

The district is also set to price Tuesday $250 million of green electric revenue bonds, 2024 Series M. J.P. Morgan.

The South Dakota Health and Educational Facilities Authority (/AA-/AA-/) is set to price Wednesday $334.100 million of Avera Health revenue bonds, Series 2024A, serials 2025-2033, 2035-2044, and terms 2049, 2054. BofA Securities.

The Maricopa County Industrial Development Authority (A2//A+/) is set to price Thursday $323.415 million of Honor Health hospital revenue bonds, consisting of $43.030 million of new-issue bonds, Series 2024A, serial 2034; and $280.385 million of forward-delivery refunding bonds, Series 2024D. RBC Capital Markets.

The Marion County School Board, Florida, (/AA//) is set to price Thursday $296.370 million of certificates of participation, Series 2024, serials 2026-2044. BofA Securities.

The Board of Regents of the University of Oklahoma (/AA//) is set to price Tuesday $217.515 million of Build America Mutual-insured general revenue bonds, consisting of $197.410 million of tax-exempt refunding bonds, Series 2024A, serials 2025-2044, terms 2049, 2054; and $20.105 million of taxables, Series 2024B, serials 2025-2039, terms 2044, 2054. Barclays.

The Jersey City Municipal Utilities Authority is set to price Wednesday $195 million, consisting of $30 million of Series 2024A, serial 2025; $80 million of Series 2024B, serial 2025; $50 million of Series 2024C, serials 2025-2044, terms 2049, 2054; and $35 million of Series 2024D, serials 2027-2039, terms 2a44, 2049, 2054. Stifel, Nicolaus & Co.

The Northside Independent School District, Texas, (Aaa//AAA/) is set to price Tuesday $161.885 million of PSF-insured unlimited tax school building bonds, Series 2024A, serials 2025-2044, terms 2049, 2054. Raymond James.

The school district is also set to price Tuesday $118.555 million of PSF-insured variable rate unlimited tax school building and refunding bonds, Series 2024B. FHN Financial Capital Markets.

The Tucson Unified School District No. 1, Arizona, (Aa3/AA/A/) is set to price Tuesday $134.240 million of Assured Guaranty-insured Project of 2023 school improvement bonds, Series A, serials 2025-2043. RBC Capital Markets.

The Delaware State Housing Authority (Aa1///) is set to price Tuesday $125 million of non-AMT senior single family mortgage revenue bonds, 2024 Series B. J.P. Morgan.

Charlotte, North Carolina, (Aa1/AA+/AA+/) is set to price Wednesday $120.510 million of Governmental Facilities and Equipment certificates of participation, Series 2024, serials 2024-2043. PNC Capital Markets.

The Union County Improvement Authority, New Jersey, (Aaa///) is set to price Thursday $102.270 million of Union County Administration Complex Project county-guaranteed lease revenue bonds, Series 2024, serials 2025-2044, terms 2049,2054. RBC Capital Markets.

Competitive

The Orange County Sanitation District, California, (Aaa/AAA/AAA/) is set to sell $138.580 million of wastewater refunding revenue obligations, Series 2024A, at 11:30 a.m. eastern Tuesday.

Denver (Aaa/AAA/AAA/) is set to $129.235 million of GO Elevate Denver bonds, Series 2024A, at 10:30 a.m. Tuesday, and $139.720 million of GO Rise Denver bonds, Series 2024B, at 11 a.m. Tuesday.

Louisiana (Aa2/AA//) is set sell $291.445 million of GOs, Series 2024A, at 10 a.m. Tuesday, and $97.020 million of GO refunding bonds, at 10:15 a.m. Tuesday.

California is set to sell $442.635 million of taxable various purpose GOs, Bid Group A, at 11 a.m. Thursday; $441.495 million of taxable various purpose GOs, Bid Group B, at 11:30 a.m. Thursday; and $600 million of tax-exempt various purpose GOs, Bid Group C, at noon Thursday.

Broome County, New York, is set to sell $123.458 million of bond anticipation notes at 11 a.m. Thursday.