The secondary market was active and trading showed strong prints across the curve, pushing triple-A yields lower following a stronger U.S. Treasury market.

Triple-A yields fell two to four basis points while UST yields fell two to three basis points.

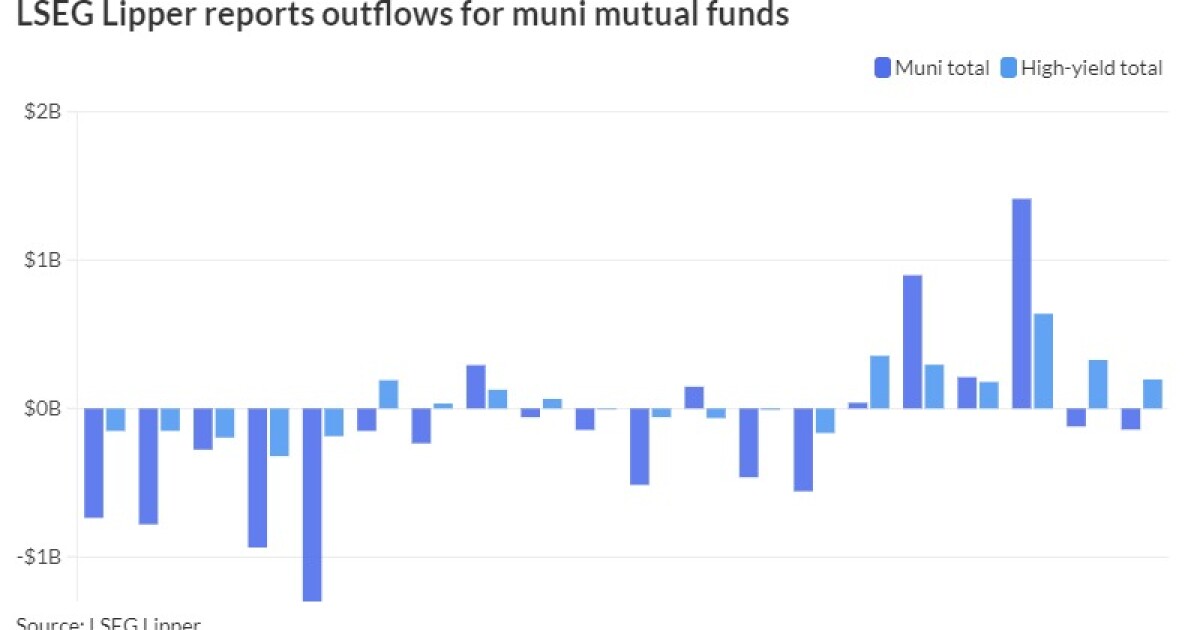

Municipal bond mutual funds saw the second week of outflows, with LSEG Lipper reporting $142.2 million of outflows for the week ending Wednesday after $121.1 million of outflows the week prior.

High-yield, though, saw inflows of $195.9 million after $327.3 million of inflows the week prior.

Muni spreads appear to rely more on fund flows than fundamentals, said Jeff Timlin, a managing partner at Sage Advisory.

“It’s all related to the inability for people to source enough bonds, and then any bonds that are out there, particularly in the new-issue market, tend to drive valuations and the general sentiment of the market,” Timlin said.

Muni-UST ratios have been in rich territory for a long time, he said.

Ratios 10 years and in have been hovering around 60%, well below their five-year averages when ratios were around 85% for two years, 78% for five years and 83% for 10 years, Timlin said.

The two-year muni-to-Treasury ratio Thursday was at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 58% and the 30-year at 81%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 60%, the three-year at 59%, the five-year at 58%, the 10-year at 58% and the 30-year at 80% at 3:30 p.m.

This, he said, is mainly driven by the supply-demand mismatch.

Supply for this week fell to just over $4 billion and will remain low during the holiday-shortened week next week.

Bond Buyer 30-day supply sits at $6.83 billion.

All the supply that previously came to market is not being “replenished” by new deals, which can create volatility, he said.

Timlin does not see supply picking up until mid to late March.

Retail investors tend to utilize munis to fund “tax liabilities that they find coming up for their tax bill,” he said. They then sell their most tax-efficient asset class, leading to more secondary supply coming to market leading up to tax season in April, he said.

However, given the lower supply outlook, certain states may outperform in the near term, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

Expected supply in New York, California and Massachusetts each stands at negative $1.1 billion, which will further pressure bid-sides, she said.

For example, California GO 5s due 2027 that were bought +3/MMD, while Massachusetts GO 5s due 2038/(callable 2034) last week traded +10/MMD vs. +18/MMD original spread, according to Olsan.

Local level names are trading through the scale, but it’s question of how deep a spread.

“A sale of Aa3/NR Easton MA GOs came with negative spreads through 12 years,” she said.

Meanwhile, “Rochester NY sold AA- GOs last week with similar results in a scale structured with all 4% coupons,” Olsan said.

Issuance for Texas, which is the second-larger issuer so far this year, “remains deeply negative at more than $5 billion,” she said.

This results in the “active PSF School sector holding on the lower end and local AA/AAA GOs compressing as well — especially for premium 5s,” she said.

Prosper TX Schools sold an issue with the 20-year maturity spread +27/MMD versus the the high range above +35/MMD from Q4 2023, she said.

Pennsylvania, Wisconsin and South Carolina are expected to see tighter trading ranges as all three states have $1 billion-plus supply deficits, she said.

“The states with the largest positive forward supply amount skew toward general market names, including Kentucky, Tennessee, Illinois and Iowa,” Olsan said.

Supply factors seem to be helping “in-state Illinois (and the state’s GOs) outperform the broad market so far this year, with a state index posting a 0.4% loss to a main index 0.8% loss,” she said.

In the competitive market Thursday, Hudson County, New Jersey, sold $140.605 million of bond anticipation notes, Series 2024, to BofA Securities, with 4s of 2/2025 at 3.11%, noncall.

The Cherokee County School System, Georgia, (Aa1/AA+//) sold $100 million of GOs, to Mesirow Financial, with 5s of 8/2024 at 2.90%, 5s of 2029 at 2.50% and 5s of 2033 at 2.43%, noncall.

Secondary trading

Connecticut 4s of 2025 at 3.07%. NYC 5s of 2026 at 2.76%-2.79% versus 2.76% on 2/5. Texas 5s of 2026 at 2.70%.

California 5s of 2028 at 2.48%. Austin electric 5s of 2029 at 2.56%. NYC 5s of 2030 at 2.52%-2.51 versus 2.55% Tuesday and 2.42%-2.41% on 2/1.

Private Colleges and Universities Authority, Georgia, 5s of 2033 at 2.63% versus 2.61%-2.64% Tuesday and 2.58% Friday. Florida BOE 5s of 2034 at 2.49% versus 2.42%-2.39% on 2/1. NYC TFA 5s of 2036 at 2.82%-2.81% versus 2.85%-2.84% Wednesday and 2.83%-2.82% Tuesday.

East Bay Municipal Utility District waters, California, 5s of 2049 at 3.42%-3.43% versus 3.47% Tuesday and 3.45%-3.44% Monday. Massachusetts 5s of 2052 at 3.86% versus 3.83%-3.78% Tuesday.

AAA scales

Refinitiv MMD’s scale was bumped two to four basis points: The one-year was at 2.94% (-2) and 2.74% (-2) in two years. The five-year was at 2.44% (-2), the 10-year at 2.46% (-2) and the 30-year at 3.59% (-3) at 3 p.m.

The ICE AAA yield curve was bumped two to three basis points: 2.96% (-2) in 2025 and 2.75% (-3) in 2026. The five-year was at 2.47% (-3), the 10-year was at 2.47% (-2) and the 30-year was at 3.55% (-2) at 3:55 p.m.

The S&P Global Market Intelligence municipal curve was bumped: The one-year was at 2.94% in 2025 and 2.74% in 2026. The five-year was at 2.44%, the 10-year was at 2.47% and the 30-year yield was at 3.57%, according to a 4 p.m. read.

Bloomberg BVAL was better by up to three basis points: 2.93% (-3) in 2025 and 2.79% (-2) in 2026. The five-year at 2.44% (-3), the 10-year at 2.51% (-3) and the 30-year at 3.62% (-3) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.58% (flat), the three-year was at 4.364% (-3), the five-year at 4.22% (-2), the 10-year at 4.24% (-3) and the 30-year Treasury was yielding 4.42% (-3) at 4 p.m.