Municipals were steady Tuesday ahead of Wednesday’s Federal Open Market Committee meeting and Consumer Price Index report, as U.S. Treasury yields fell and equities were mixed near the close.

“The market’s great expectations regarding Fed cuts have witnessed a dramatic downward adjustment since the start of the year,” said Vikram Rai, head of municipal markets strategy at Wells Fargo, noting there are “significantly higher” expectations regarding economic activity, job growth and inflation since the start of 2024.

While rates are higher across the curve year-to-date to reflect that better-than-expected economic data, “investors also realize that the catalysts for higher rates are unlikely to be as strong,” Rai said. “That is, the market understands that the hurdle rate for the Fed to cut sooner rather than later is high and that rates are going to be higher-for-longer has been priced in (the market is now pricing only 1 cut this year).”

With the FOMC meeting and CPI report happening this week, he said if inflation is lower than expectations or if the Fed is more dovish, “the potential for yields to drop in step functions is high.”

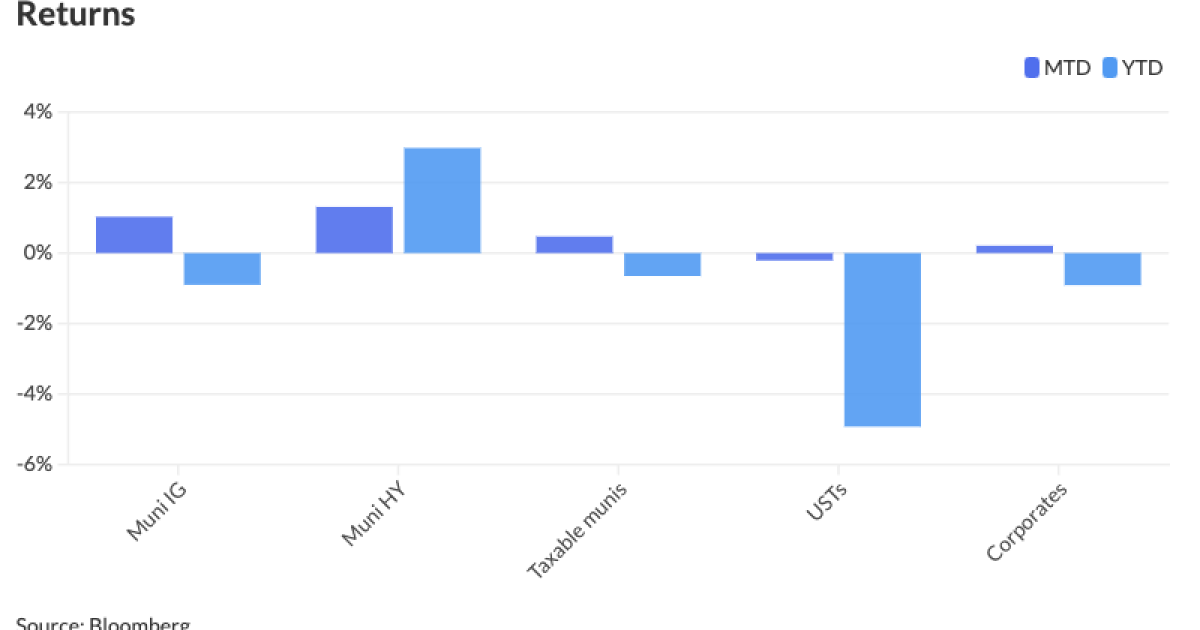

While muni-UST ratios have fallen since Friday’s UST selloff, Rai said valuations are still “compelling.”

The two-year muni-to-Treasury ratio Tuesday was at 65%, the three-year at 66%, the five-year at 67%, the 10-year at 66% and the 30-year at 84%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 66%, the five-year at 66%, the 10-year at 67% and the 30-year at 83% at 3:30 p.m.

“We will remain cautious until CPI and the FOMC are in the rear-view mirror and as long as these don’t catalyze a sell-off (since that would trigger outflows) or catalyze a sharp rally (as municipals lag rates during a sharp rally and ratios can increase optically) … ratios should hold steady and even tighten and lead to this week’s supply being absorbed well,” he said.

Tuesday was a particularly busy day in the primary market led by Morgan Stanley pricing for Los Angeles County $700 million of 2024-2025 tax and revenue anticipation notes, with 5s of 6/2025 at 3.25%, noncall.

Barclays priced for the Massachusetts Water Resources Authority (Aa1/AA+/AA+/) $446.2 million of green general revenue bonds. The first tranche, $166.55 million of new-issue bonds, Series B, saw 5s of 8/2025 at 3.29%, 5s of 2029 at 3.05%, 5s of 2034 at 3.03%, 5s of 2039 at 3.31%, 5s of 2044 at 3.68% and 5s of 2049 at 3.90%, callable 8/1/2034.

The second tranche, $279.65 million of refunding bonds, Series C, saw 5s of 8/2027 at 3.14%, 5s of 2029 at 3.05%, 5s of 2034 at 3.03%, 5s of 2039 at 3.31% and 5s of 2042 at 3.58%, callable 8/1/2034.

Morgan Stanley priced for the New York City Housing Development Corp. (Aa2/AA+//) $440.385 million of non-AMT sustainable development multi-family housing revenue bonds. The first tranche, $121.065 million of 2024 Series B-1-A, saw all bonds price at par: 3.6s of 11/2029, 3.95s of 5/2034, 3.95s of 11/2035, 4.125s of 11/2039, 4.5s of 11/2044, 4.65s of 11/2049, 4.75s of 11/2054, 4.85s of 11/2059 and 4.9s of 5/2064, callable 5/1/2032.

The second tranche, $7.595 million of 2024 Series B-1-B, saw all bonds price at par: 4.5s of 11/2044, 4.75s of 2054 and 4.85s of 2059, callable 5/1/2032.

The third tranche, $311.725 million of 2024 Series B-2, saw 3.7s of 5/2064 with a tender date of 7/3/2028 priced at par, callable 2/1/2028.

BofA Securities priced for the Mobile County Industrial Development Authority, Alabama, (Baa3/BBB-//) is set to price Tuesday $378 million of AMT AM/NS Calvert Project solid waste disposal revenue bonds, with 5s of 6/2054 at par.

BofA Securities priced for the Michigan State University Board of Trustees (Aa2/AA//) $361.485 million of general revenue bonds, series 2024A, with 5s of 8/2025 at 3.27%, 5s of 2029 at 3.09%, 5s of 2034 at 3.10%, 5s of 2039 at 3.42%, 5s of 2044 at 3.81%, 5s of 2049 at 4.06% and 5.25s of 2054 at 4.13%, callable 8/15/2034.

Wells Fargo priced for the Maryland Economic Development Corporation (A3///) $350.84 million of

Barclays priced for the Connecticut Health and Educational Facilities Authority (/AA-/A+/) $315.935 million of Yale New Haven Health Issue revenue refunding bonds. The first tranche, $157.265 million of Series 2024A, saw 5s of 7/2025 at 3.40%, 5s of 2029 at 3.32%, 5s of 2034 at 3.31%, 5s of 2044 at 3.96% and 5s of 2048 at 4.10%, callable 7/1/2034.

The second tranche, $158.67 million of Series 2024B, saw 5s of 7/2049 with a mandatory put date of 7/1/2029 at 3.45%, callable 1/1/2029.

J.P. Morgan priced for the New Mexico Finance Authority (Aa1/AA+//AAA/) $117.515 million of State Transportation Commission senior lien state transportation refunding revenue bonds, Series 2024A, with 5s of 6/2025 at 3.31%, 5s of 2029 at 3.13% and 5s of 2031 at 3.11%, noncall.

Despite the drop in supply, the forward supply calendar remains “elevated” compared to previous seasonal averages, said Matt Fabian, partner at Municipal Market Analytics.

“Price resilience reflects tax-exempt paper having already been priced to sell, with sufficient nominal yields (4s and 5s with spread available near par) and cheaper relative value,” he said.

A “massive” seasonal reinvestment is underway, which “entails the redeployment of $107 billion in tax-exempt principal maturing between [June 1 and Aug. 31],” Fabian said.

Net customer buying surged to nearly 15-year highs at $26.9 billion as demand is still mainly separately managed account-oriented small lot trades, he said.

Mainly due to money market funds, “seemingly as a temporary holding by reinvestors,” fund flows were above $3 billion, leading to SIFMA falling below 3% for the first time since January.

AAA scales

Refinitiv MMD’s scale was unchanged: The one-year was at 3.20% and 3.16% in two years. The five-year was at 2.97%, the 10-year at 2.92% and the 30-year at 3.79% at 3 p.m.

The ICE AAA yield curve was unchanged: 3.26% in 2025 and 3.19% in 2026. The five-year was at 2.98%, the 10-year was at 2.96% and the 30-year was at 3.81% at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut two basis points out long: The one-year was at 3.25% (unch) in 2025 and 3.17% (unch) in 2026. The five-year was at 2.96% (unch), the 10-year was at 2.94% (+2) and the 30-year yield was at 3.79% (+2), at 3 p.m.

Bloomberg BVAL was little changed: 3.26% (unch) in 2025 and 3.21% (unch) in 2026. The five-year at 2.99% (unch), the 10-year at 2.92% (unch) and the 30-year at 3.80% (unch) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.829% (-5), the three-year was at 4.590% (-8), the five-year at 4.414% (-7), the 10-year at 4.399% (-7), the 20-year at 4.624% (-6) and the 30-year at 4.533% (-6) at the close.

Layla Kennington contributed to this story.