Municipals were slightly firmer Wednesday as the New York City Transitional Finance Authority came to market with a $1.8 billion deal with small bumps from its retail offering and inflows into exchange-traded funds topped $1 billion. U.S. Treasuries and equities rallied following the consumer price index report that came in softer than expected.

April’s CPI report was a “market-friendly number,” coming in below expectations, said Jeff Lipton, a research analyst and market strategist.

The CPI print keeps the possibility of the Fed cutting rates at least once this year, potentially at least two rate cuts if the CPI figure points to a trend of inflation falling further, he said.

However, he noted confidence needs to be “rebuilt” in achieving the Fed’s 2% target.

Following the CPI figure, munis underperformed USTs, which saw yields fall eight to 11 basis points.

While munis are “directionally aligned” with USTs, Lipton said “muni yields are nevertheless guided by their own unique technical forces as the bond market seeks to identify a realistic trading range given the presence of both a strong labor market and stubborn inflation.”

Issuance was lighter than Tuesday, led by $1.8 billion of tax-exempt future tax-secured subordinate bonds from the New York City Transitional Finance Authority.

In the primary market Wednesday, RBC Capital Markets priced for institutions $1.5 billion of tax-exempt future tax-secured subordinate bonds, Fiscal 2024 Series G, Subseries G-1, for the New York City Transitional Finance Authority’s (Aa1/AAA/AAA/), with small bumps from Tuesday’s retail order: 5s of 5/2026 at 3.15% (-3), 5s of 2029 at 2.91% (-1), 5s of 2036 at 3.10% (unch), 5s of 2039 at 3.39% (unch), 5s of 2044 at 3.79% (unch), 5.25s of 2049 at 3.92% (-4), 4.125s of 2052 at 4.25% (-1) and 5s of 2052 at 3.99%, callable 5/1/2034.

In the competitive market, the authority sold $160.26 million of taxable future tax-secured subordinate bonds, Fiscal 2024 Subseries G-2, to J.P. Morgan, with all bonds priced at par: 4.83s of 5/2030 and 4.97s of 2033, noncall.

The authority also sold $139.74 million of taxable future tax-secured subordinate bonds, Fiscal 2024 Subseries G-3, to J.P. Morgan, with all bonds priced at par: 5.01s of 5/2034 and 5.11s of 2036, callable 5/1/2034.

Elsewhere, TD Securities held a one-day retail order for the Los Angeles Department of Water and Power’s (Aa2/AA+//AA+/) $448.345 million of water system revenue bonds, 2024 Series B, in the primary market, with 5s of 7/2024 at 3.40%, 5s of 2029 at 2.67%, 5s of 2034 at 2.72%, 5s of 2039 at 3.13% and 5s of 2044 at 3.55%, callable 7/1/2034.

BOK Financial Securities preliminarily priced for Georgetown, Texas, (/AA//) $117.71 million of BAM-insured utility system revenue bonds, Series 2024, in the primary market, with 5s of 8/2025 at 3.34%, 5s of 2029 at 3.05%, 5s of 2034 at 3.14%, 5s of 2039 at 3.51%, 5s of 2044 at 3.89%, 4s of 2049 at 4.34% and 4.125s of 2054 at 4.42%, callable 8/15/2033.

Virginia Beach, Virginia, (Aaa/AAA/AAA/) sold $118 million of GO public improvement bonds, Series 2024B, to J.P. Morgan, in the competitive market, with 5s of 2025 at 3.25%, 5s of 2029 at 2.75%, 5s of 2034 at 2.76%, 5s of 2039 at 3.16% and 4s of 2044 at 3.92%.

The continued influx in supply is due to waning pandemic-related stimulus, growing comfort with monetary policy, and issuers bringing deals ahead of the upcoming November election, Lipton said.

“The muni market is set up nicely heading into the summer,” he said.

The “muni story” is likely to improve as demand strengthens into the heavy reinvestment cycle over the summer and a “positive fund flow bias” becomes more visible. There will be allocations into traditional muni mutual funds, while deposits in separately managed accounts become more “pronounced,” Lipton added.

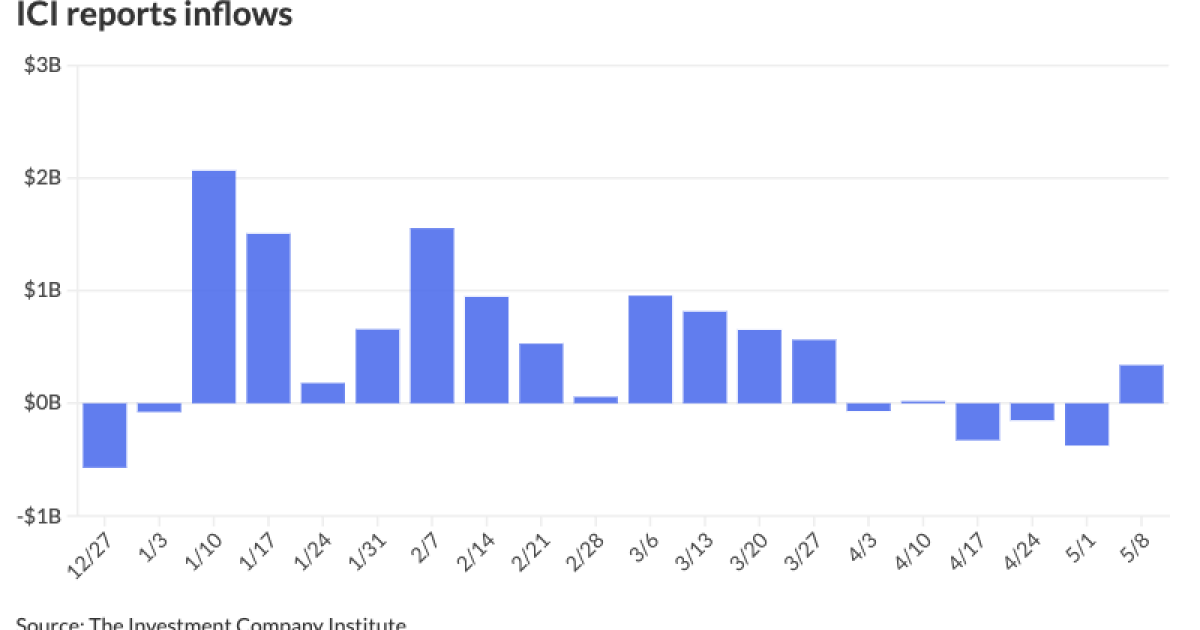

The Investment Company Institute reported inflows from municipal bond mutual funds for the week ending May 8, with investors adding $339 million from funds following $375 million of outflows the week prior.

ICI reported exchange-traded funds saw inflows of $1.266 billion following $319 million of inflows the week prior.

“During the summer period, any performance can slip into green territory on a year-to-date basis, yet ratios will likely stay rich,” he said.

The two-year muni-to-Treasury ratio Wednesday was at 65%, the three-year at 64%, the five-year at 63%, the 10-year at 63% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 64%, the three-year at 63%, the five-year at 62%, the 10-year at 62% and the 30-year at 81% at 3:30 p.m.

Rich ratios will guide duration policy for institutional buyers, Lipton said.

AAA scales

Refinitiv MMD’s scale saw some small bumps: The one-year was at 3.21% (-2) and 3.07% (unch) in two years. The five-year was at 2.74% (unch), the 10-year at 2.73% (unch) and the 30-year at 3.76% (-1) at 3 p.m.

The ICE AAA yield curve was bumped one to three basis points: 3.22% (-3) in 2025 and 3.07% (-2) in 2026. The five-year was at 2.77% (-1), the 10-year was at 2.72% (-1) and the 30-year was at 3.73% (-2) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was little changed: The one-year was at 3.27% (unch) in 2025 and 3.08% (unch) in 2026. The five-year was at 2.73% (unch), the 10-year was at 2.71% (unch) and the 30-year yield was at 3.74% (-2), according to a 3 p.m. read.

Bloomberg BVAL was bumped one to two basis points: 3.29% (-2) in 2025 and 3.10% (-1) in 2026. The five-year at 2.66% (-1), the 10-year at 2.63% (-1) and the 30-year at 3.77% (-2) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.737% (-9), the three-year was at 4.518% (-10), the five-year at 4.360% (-11), the 10-year at 4.358% (-10), the 20-year at 4.613% (-9) and the 30-year at 4.517% (-8) near the close.

CPI

While analysts agreed the April consumer price index would be seen as favorable by the Federal Reserve, sentiment was mixed as to what it means for rate cuts.

After the release, Treasuries rallied, “with the two-year yield trading down 9 basis points and the 10-year yield down a similar amount,” noted Scott Anderson, chief U.S. economist and managing director at BMO Economics. “The Fed funds futures market is solidifying around a rate cut at the September meeting.”

But while the report offers “an encouraging signal that consumer inflation pressures may be moderating a bit more visibly across a broader cross-section of categories,” it would take more months of the same to “keep Fed rate-cut expectations for September and December alive and well.”

He added, “Clearly, restrictive monetary policy has more work to do, and the Fed will remain patient and watchful.”

Following the CPI report, the markets’ reaction was positive, with the U.S. 10-year Treasury note yield easing, said, Wells Fargo Investment Institute Head of Global Investment Strategy Paul Christopher. The numbers were “a hopeful sign (though certainly not yet a trend) that disinflation will resume in the coming months.”

The “process of economic and inflation slowing, and then rate cuts,” is still in the early stages, he noted, and a spike in inflation into the summer could delay Fed action. Still, Christopher said, “if inflation cooperates and continues to cool, the Fed probably needs only another two to three reports of cooling inflation before it starts to cut (probably in the autumn).”

The market rally was spurred by “weaker-than-expected economic data dampening concerns of a prolonged journey across the monetary policy bridge,” said José Torres, senior economist at Interactive Brokers. “Overall, fears of a consumer slowdown are incrementally increasing, with households pressured by elevated prices, lofty interest rates and reduced credit availability. The stagflationary combination points to the first rate cut happening in September but odds of a July cut are rising as economic activity continues to surprise to the downside.”

The report offers “some relief for the Fed, as the first better-than-expected (lower) reading in 2024,” said James Ragan, director of wealth management research at D.A. Davidson, and “increases the chances of a move lower in the fed funds target this year.”

The data, he said, raised the potential for rate cuts this year.

Ragan noted both the two-year and 10-year Treasury yields “moved sharply lower today, and the futures market reaction now looks at 70% odds of at least 25bps of cuts by the September Federal Open Market Committee meeting, vs 64% yesterday.”

But work remains, he said. “The Fed wants to see confirmation of a trend, and it will a take a couple more positive month-over-month reports to allow the Fed to begin easing.” Still a cut is unlikely before September, Ragan said.

Although “the Fed may be right about policy weighing on the economy and pushing prices down,” Chris Low, chief economist at FHN Financial, said, the slow pace at which it’s working “is unlikely to alter higher-for-longer rhetoric.”

And while the market is pricing in a September cut, he said, “it will likely take at least a full quarter of mostly good inflation data for the Fed to feel confident making the first cut.”

The data support a soft landing scenario, according to Brian Rose, senior U.S. economist at UBS Global Wealth Management. “Both inflation and consumer spending appear to be cooling off, but at least so far, nothing in the data suggests that the economy is heading for a hard landing. We maintain our view that the Fed will start cutting rates in September, and this should lead to lower bond yields by year-end. In our investment strategy, we maintain a preference for quality bonds.”

Wells Fargo Securities senior economists Sarah House and Michael Pugliese also expect a cut in September. “The smaller sequential increase in core PCE in April would be a step in the right direction for the Fed to regain some confidence that inflation is subsiding, but we believe it will take at least a few more benign inflation readings for the FOMC to feel sufficiently confident to begin lowering the fed funds rate.”

Still “any additional bumps in the road” could delay cuts, they said.

The markets’ positive reaction “seems appropriate,” said Greg Wilensky, head of U.S. fixed income at Janus Henderson Investors.

While hopes of a July cut remain “alive,” he said, it would require “a combination of more meaningful positive inflation news and/or more concrete signs of labor market weakness over the next 10 weeks.”

The above-projected inflation of the past few months “was more noise than signal, said Alexandra Wilson-Elizondo, co-chief investment officer of the multi-asset solutions business in Goldman Sachs Asset Management.

However, “the breadth of upward surprises in components was cause for concern.”

And while this report “should assuage near-term fears that inflation has been re-accelerating,” said Josh Jamner, investment strategy analyst at ClearBridge Investments, “the Fed will want to see further data showing that inflation has resumed its drift lower before gaining confidence that they can lower interest rates.”

Still, this “should begin to shift the narrative back toward when the Fed will cut in 2024 rather than if they will cut,” he said.

“While one month does not make a trend,” noted Phillip Neuhart, director of market and economic research at First Citizens Wealth, “today’s report leaves the door open for the Federal Reserve to cut the federal funds rate by the end of September.”

Michael Brown, senior research strategist at Pepperstone, said, the report alone is ”not enough to provide policymakers with the required confidence to deliver a rate cut just yet.”

The most likely cut start would be by in September, “barring significant labor market weakness before then,” he said.

Still, others were not necessarily buying into a September start of cutting.

Mercatus Center macroeconomist Patrick Horan said, “Although the slight cooling in inflation is encouraging, I doubt it will affect the Fed’s calculus on projected interest rate cuts later this year.”

It will take “several consecutive months of evidence showing inflation — which is proving far stickier that had been hoped — is really heading back to the 2% target before they consider a pivot on monetary policy,” said Nigel Green CEO of the deVere Group. ”As such, we still expect there’s a considerable risk that they will not feel comfortable about cutting rates before 2025.”

The data “does little to ease fears of core inflation persistence,” said Brian Coulton, Fitch Ratings chief economist. ”Really not much in here at all to re-ignite hopes of imminent rate cuts.”

Gary Siegel contributed to this story.