Municipals improved Monday in constructive secondary trading as investors await the larger new-issue slate. U.S. Treasuries were mixed while equities made gains.

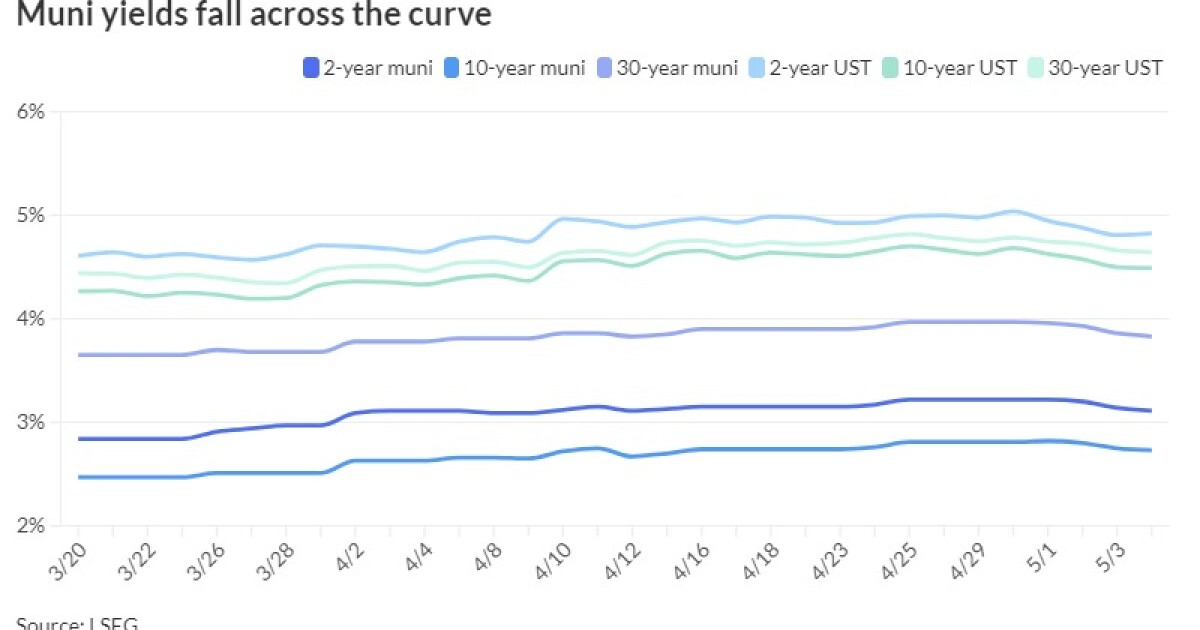

Triple-A curves saw yields fall two to three basis points while USTs were a touch weaker on the short end and a bit firmer out long.

The two-year muni-to-Treasury ratio Monday was at 64%, the three-year at 63%, the five-year at 61%, the 10-year at 61% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 64%, the five-year at 61%, the 10-year at 61% and the 30-year at 82% at 3:30 p.m.

The last week “was eventful” as slowing job growth and Federal Reserve Chairman Jerome Powell’s guidance earlier in the week that the Fed’s focus is “shifting back toward the employment mandate (and that hikes are not being actively considered) led to a sharp dovish repricing of Fed policy expectations,” noted Vikram Rai, senior strategist at Wells Fargo.

Rai said interest rate markets are now implying about 45% probability of a 25-basis point rate cut by July, noting two-year reasury yields fell more than 20 basis points from their high on Tuesday and the 10-year fell 17 basis points.

Investment-grade muni yields rallied along with USTs, “though not commensurately and have underperformed almost across the curve with the exception of the 30-year tenor,” Rai said. “We remain cautious with respect to duration given the uncertain macro and geopolitical environment though optically, yields seem attractive in the current range.”

With tax-exempt rates “just off year-to-date highs, we continue to recommend adding duration and structural risk in advance of lower UST rates entering mid-year and strong municipal market summer technicals,” noted J.P. Morgan in a morning market note. “We like barbell structures for total return-based investors; however, even investors locked into the less attractive 5-12yr area of the curve, or flatter 25yrs and longer, should like current levels as we expect to see even lower yields in mid-year.”

Jeff Klingelhofer and Eve Lando, co-head of investments and portfolio manager at Thornburg Investment Management, said the “big overarching risk for the municipal market is that the Fed may have to price out some of those existing rate cuts or potentially even resort to rate hikes in the future.”

Klingelhofer and Lando said investors should take a “very cautious approach,” creating durability of an income stream.

“And that’s exactly how we want to be thinking about the market, focusing on the higher quality of issuers and really playing for defense, waiting for potentially better opportunities to open up,” they said.

AAA scales

Refinitiv MMD’s scale was bumped two to three basis points: The one-year was at 3.29% (-3) and 3.11% (-3) in two years. The five-year was at 2.7%5 (-3), the 10-year at 2.73% (-2) and the 30-year at 3.83% (-3) at 3 p.m.

The ICE AAA yield curve was bumped up to two basis points: 3.32% (-2) in 2025 and 3.14% (-2) in 2026. The five-year was at 2.77% (-2), the 10-year was at 2.75% (-2) and the 30-year was at 3.81% (-2) at 3:15 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to three basis points: The one-year was at 3.33% (-3) in 2025 and 3.10% (-3) in 2026. The five-year was at 2.73% (-2), the 10-year was at 2.72% (-2) and the 30-year yield was at 3.81% (-3), according to a 3 p.m. read.

Bloomberg BVAL was bumped up to four basis points: 3.36% (-2) in 2025 and 3.14% (-4) in 2026. The five-year at 2.70% (-2), the 10-year at 2.68% (-2) and the 30-year at 3.84% (-2) at 3 p.m.

Treasuries were mixed.

The two-year UST was yielding 4.824% (+2), the three-year was at 4.646% (+1), the five-year at 4.487% (flat), the 10-year at 4.491% (-1), the 20-year at 4.74% (-2) and the 30-year at 4.645% (-2) at 3:30 p.m.

Primary to come:

The Illinois Finance Authority (Aa2/AA-/AA+/) is set to price next week $947.43 million of the University of Chicago revenue bonds, consisting of $484.625 million of Series 2024A and $462.805 million of Series 2024B. RBC Capital Markets.

Columbus, Ohio, (Aaa/AAA/AAA/) is set to price Thursday $467.455 million of various purpose GOs, consisting of $293.755 million of unlimited tax bonds, Series 2024A; $22.29 million of limited tax bonds, Series 2024B; $76.72 million of taxable unlimited tax bonds, Series 2024C; $15.385 million of taxable limited tax bonds, Series 2024D; and $59.305 million of unlimited tax refunding bonds, Series 2024-1. J.P. Morgan.

The Chandler Industrial Development Authority, Arizona, (A3/A-//) is set to price Tuesday $437.885 million of AMT Intel Corp. Project industrial development revenue bonds, Series 2019. J.P. Morgan.

San Francisco (Aaa/AAA/AAA/) is set to price Thursday $345 million of GO refunding bonds, Series 2024-R1, serials 2025-2036. Stifel.

The San Diego Unified School District (Aa2//AAA/AAA/) is set to price Tuesday $309.14 million of GO refunding bonds. Jefferies.

Energy Northwest (Aa1/AA-/AA/) is set to price Wednesday $266.460 million of electric station revenue bonds, consisting of $189.94 million of Project 1 refunding bonds, Series 2024-B, serials 2025-2027; $9.595 million of Columbia Generating Station bonds, Series 2024-B, serial 2031; and $66.925 million of Project 3 refunding bonds, Series 2024-B, serial 2028. Wells Fargo.

The New Jersey Health Care Facilities Financing Authority (A1/AA-//) is set to price Thursday $256.055 million of RWJ Barnabas Health refunding bonds, Series 2024B. Jefferies.

The Virginia Housing Development Authority (Aaa/AAA//) is set to price Tuesday $240 million of commonwealth mortgage bonds, consisting of $80 million of non-AMT bonds, 2024 Series E, Subseries E-2, serials 2025-2036, terms 2039, 2044, 2049, 2054; and $160 million of taxables, 2024 Series B, serials 2025-2034, terms 2039, 2044, 2049, 2054. Wells Fargo.

The

The Clifton Higher Education Finance Corp., Texas, (/AAA//) is set to price Wednesday $202.99 million of PSF-insured Idea Public Schools education revenue and refunding bonds, Series 2024, serials 2024-2044, terms 2049, 2054. Baird.

The New Caney Independent School, Texas, (Aaa//AAA/) is set to price Tuesday $200 million of PSF-insured unlimited tax school building bonds, Series 2024. Piper Sandler.

The Clovis Unified School District, California, (/AA//) is set to price Tuesday $195.675 million of GOs. Stifel.

The Missouri Housing Development Commission (/AA+//) is set to price Tuesday $195 million of single-family mortgage revenue bonds, consisting of $180 million of Series 2024C, serials 2025-2036, terms 2039, 2044, 2049, 2054, 2055; and $15 million of Series 2024D, serials 2025-2034, terms 2039, 2044, 2049, 2054. Stifel.

Hamilton County, Ohio, (Aa2/AA+//) is set to price Tuesday $166.305 million of the Metropolitan Sewer District of Greater Cincinnati sewer system revenue bonds, consisting of $100 million of new-issue bonds, 2024 Series A, serials 2025-2053; and $66.305 million of forward-delivery refunding bonds, 2024 Series B, serials 2024-2032. RBC Capital Markets.

The Weslaco Independent School District, Texas, (/AAA/AAA/) is set to price Tuesday $160 million of tax school building bonds, Series 2024, serials 2025-2054. Frost Bank.

The Black Desert Public Infrastructure District, Utah, is set to price Wednesday $151.535 million of non-rated Black Desert Assessment Area #1 special assessment bonds, Series 2024. D.A. Davidson.

The Racine Unified School District, Wisconsin, is set to price Thursday $150 million of GO promissory notes, Series 2024. Baird.

The Garden Grove Public Financing Authority, California, (/AA//) is set to price Wednesday $140 million of lease revenue bonds, Series 2024A, serials 2025-2044, terms 2049, 2054. Stifel.

The Hampton Roads Sanitation District, Virginia, (/AA+//) is set to price Tuesday $117.73 million of wastewater revenue refunding bonds, Series 2024A, serials 2024-2039. Wells Fargo.

The Utah Housing Corp. (Aa2///) is set to price Thursday $114.805 million of taxable single family mortgage bonds, 2024 Series F. Jefferies.

Polk County, Iowa, (Aaa/AAA//) is set to price Wednesday $113.005 million of GO capital loan notes, Series 2024A. J.P. Morgan.

The Kentucky Asset/Liability Commission (/AA//) is set to price Wednesday $107.440 million of Federal Highway Trust Fund first refunding project notes, 2024 Series A. J.P. Morgan.

Competitive

Augusta, Georgia, (Aa2/AA//) is set to sell $250 million of taxable GOs at 10:30 a.m. Tuesday.

Hempstead, New York, is set to sell $194.547 million of public improvement serial bond at 11 a.m. Wednesday.